CTBC Bank has a genuine commitment to sustainable finance. We

are constantly taking on greater corporate social responsibility

and putting sustainable development at the core of our business.

As part of these efforts, we proudly became a signatory to the

Equator Principles (EPs) on Jan. 23, 2019.

We use these principles—which are widely regarded as

constituting best practice in sustainable finance—to actively

manage the potential environmental and social risks of our

corporate loans. This not only helps prevent negative

repercussions for the Bank, both financial and non-financial,

but delivers tangible protection to the community. Adopting the

EPs is a key step for us in working more closely with clients to

realize our vision of corporate citizenship and emphasize that

“We are family” is much more than a slogan.

The EPs are a voluntary standard based on the sustainable development policies and guidelines of the International Finance Corporation and the World Bank. They together form a risk management framework that financial institutions can use to assess and manage the environmental and social risks of potential corporate projects.

As a signatory, we apply the EPs by weighing the risks of five financial products: Project finance advisory services, project finance, project-related corporate loans, bridge loans, and project-related refinance and project-related acquisition finance. Each of these is classified into one of three categories, A, B, or C, based on the seriousness of its potential environmental and social risks. For projects that pass the process, we utilize covenants and post-loan monitoring to ensure compliance with the EPs even after financial close.

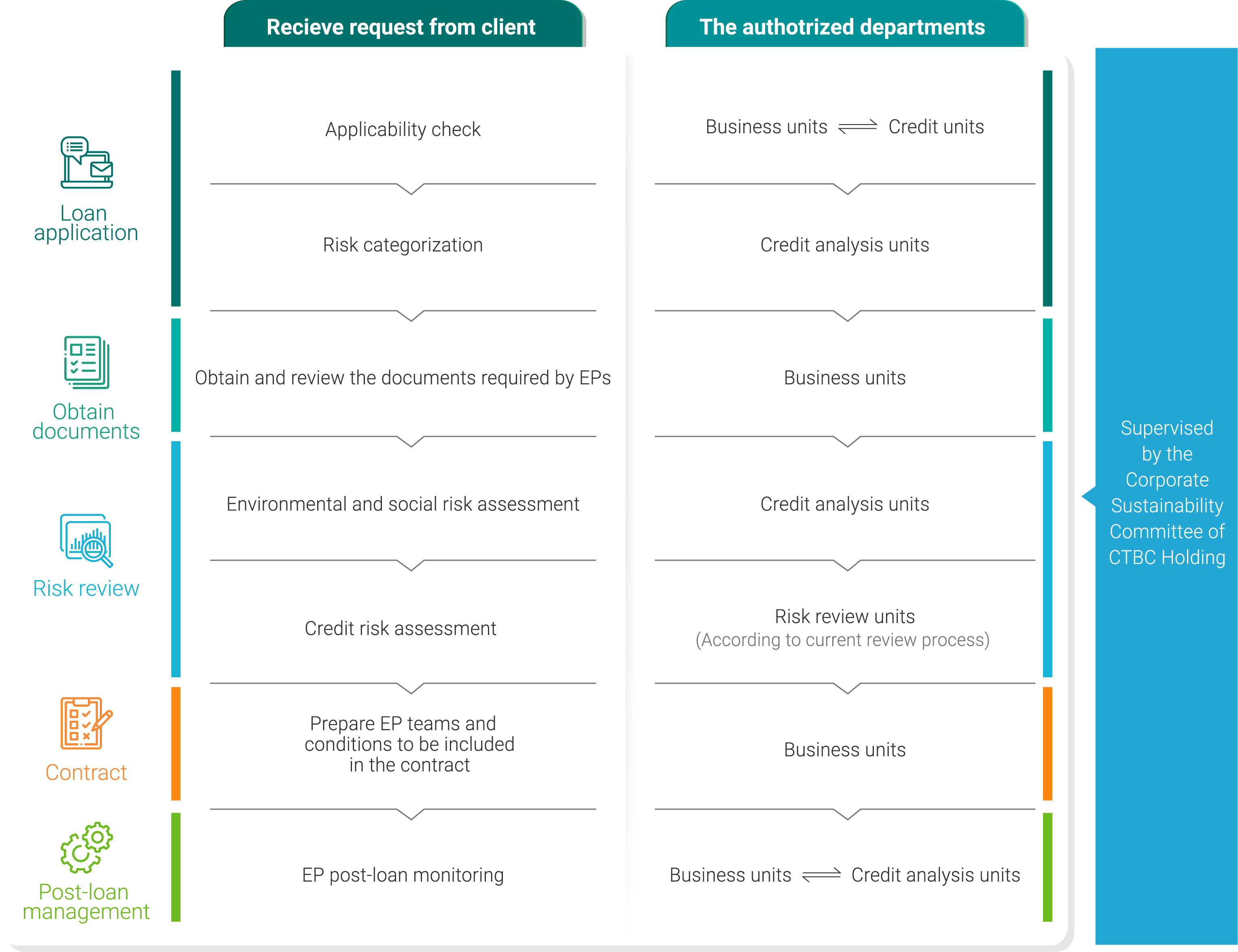

The Bank established Guidelines for Corporate Loans Applicable to

the Equator Principles. They authorize CTBC Holding's

Sustainability Committee to supervise all relevant business, risk

management, and administrative units to ensure they fulfill their

respective roles and responsibilities in ensuring EP-compliant

environmental and social risk management when assessing corporate

loans.

The guidelines clearly lay out the roles and responsibilities of

all relevant units, the credit process for EP-applicable projects,

the terms and conditions for such projects, and information

disclosure management. For our subsidiaries in Japan, Indonesia,

the Philippines, the United States, and Canada, localized policies

have been established to ensure their implementation of the EPs is

consistent with that of the parent company.

The Bank assigns tasks in accordance with the existing roles and

responsibilities of its units, the key duties of which are as

follows:

| By industry sector | Total |

|---|---|

| Mining | 0 |

| Infrastructure | 0 |

| Oil and gas | 0 |

| Power | 0 |

| Others | 0 |

| By region | Total |

| Americas | 0 |

| Europe/Middle East/Africa | 0 |

| Asia/Oceania | 0 |

| Category A | Category B | Category C | Total | |

|---|---|---|---|---|

| By sector | ||||

| Mining | 0 | 0 | 0 | 0 |

| Infrastructure | 0 | 0 | 0 | 0 |

| Oil and gas | 0 | 0 | 0 | 0 |

| Power | 0 | 2 | 0 | 0 |

| Others | 0 | 0 | 0 | 0 |

| By region | ||||

| Americas | 0 | 0 | 0 | 0 |

|

Europe/Middle East /Africa |

0 | 0 | 0 | 0 |

| Asia/Oceania | 0 | 2 | 0 | 0 |

| By country | ||||

| Designated | 0 | 0 | 0 | 0 |

| Non-designated | 0 | 2 | 0 | 0 |

| Independent review | ||||

| Yes | 0 | 2 | 0 | 0 |

| No | 0 | 0 | 0 | 0 |

| Total | ||||

| Total number | 0 | 2 | 0 | 0 |

| Category A | Category B | Category C | Total | |

|---|---|---|---|---|

| By sector | ||||

| Mining | 0 | 0 | 0 | 0 |

| Infrastructure | 0 | 0 | 0 | 0 |

| Oil and gas | 0 | 0 | 0 | 0 |

| Power | 0 | 0 | 0 | 0 |

| Others | 0 | 0 | 0 | 0 |

| By region | ||||

| Americas | 0 | 0 | 0 | 0 |

|

Europe/Middle East /Africa |

0 | 0 | 0 | 0 |

| Asia/Oceania | 0 | 0 | 0 | 0 |

| By country | ||||

| Designated | 0 | 0 | 0 | 0 |

| Non-designated | 0 | 0 | 0 | 0 |

| Independent review | ||||

| Yes | 0 | 0 | 0 | 0 |

| No | 0 | 0 | 0 | 0 |

| Total | ||||

| Total number | 0 | 0 | 0 | 0 |

| By industry sector | Total |

|---|---|

| Mining | 0 |

| Infrastructure | 0 |

| Oil and gas | 0 |

| Power | 0 |

| Others | 0 |

| By region | Total |

|---|---|

| Americas | 0 |

| Europe/Middle East/Africa | 0 |

| Asia/Oceania | 0 |

| By country | Total |

|---|---|

| Designated | 0 |

| Non-designated | 0 |

CTBC Bank, SinoPac Bank, Cathay United Bank and Taipei Fubon Bank jointly arranged "SunnyRich Fishery Solar Power Plant" syndicated loan, which supports the largest indoor aquaculture integrated solar power generation facilities in Taiwan, promotes multiple use of the land, and responds to the government’s renewable energy policy.

The project is located in the Yizhu Township, Chiayi County. The capacity of the first phase of project is approximately 130MW. With the relevant technology applied, the project can operates power generation facilities concurrently with fishery business. Such business model improves the aquaculture environment, promotes the reconstruction of fishing villages, drives youth to return to home, and contributes the revitalization for regional industries.

CTBC Bank, SinoPac Bank, and Mega Bank have completed a NT$4 billion syndicated loan for the development and construction of a floating solar power plant (Lunwei East No. 3 power plant), located in Changbin Industrial Park, with a total capacity of 67MW for Chenhua Power, a subsidiary of Chenya Energy Group. CTBC Bank acts as agent for the financing.

The sponsor and the largest shareholder is Chenya Energy, a wholly-owned subsidiary by Marubeni Corporation. Three lifers including China Life, Shin Kong Life Insurance and TransGlobe Life Insurance also committed NT$ 450 million each as co-investors. Chenya Energy No.1, No.2, and No.3 power plants have total installed capacity of 248MW, with aggregated power generated setting a record for the world's largest floating solar power plant.

CTBC Bank together with HSBC were mandated as the financial advisors for the project financing of the 605MW Greater Changhua 1 Offshore Wind Farm. Through the arrangement of the green project financing and also through building local partnership with local suppliers and international enterprises, CTBC supports government mandates to drive the green energy transition and promoting the localization of offshore wind energy sector, and contributes to achieving the sustainable development goals of clean energy development, climate change mitigation, and community development to create positive environmental and social impact.

The Greater Changhua 1 Offshore Wind Farm being developed by Orsted, a Danish renewable-focus, energy company based in Denmark, is one of its four offshore wind projects in Greater Changhua. In April 2018, the 605 MW project has passed the EIA review. The project is expected to create about 1,100 direct job opportunities during the development, construction and operation phase.