As part of its efforts to actively use the financial sector's influence to promote environmental, social, and corporate governance (ESG) sustainability, CTBC Bank announced its voluntary compliance with the U.N. Principles for Responsible Banking (PRB) on Dec. 26, 2019. Leveraging its strong corporate structure, CTBC Bank is committed to facilitating the sustainable development of the global financial system while providing its clients with professional and attentive financial services and implementing corporate social responsibility in an effort to help realize its vision of sustainability and the common good.

Officially launched at the U.N. General Assembly on Sept. 23, 2019, the PRB are a crucial benchmark that ensures that the practices of signatory banks align with the U.N.'s 2030 Sustainable Development Goals and Paris Agreement. Jointly formulated by the U.N. Environment Programme Finance Initiative and 30 founding banks worldwide, the PRB serve as a universal system for banks to achieve sustainable development.

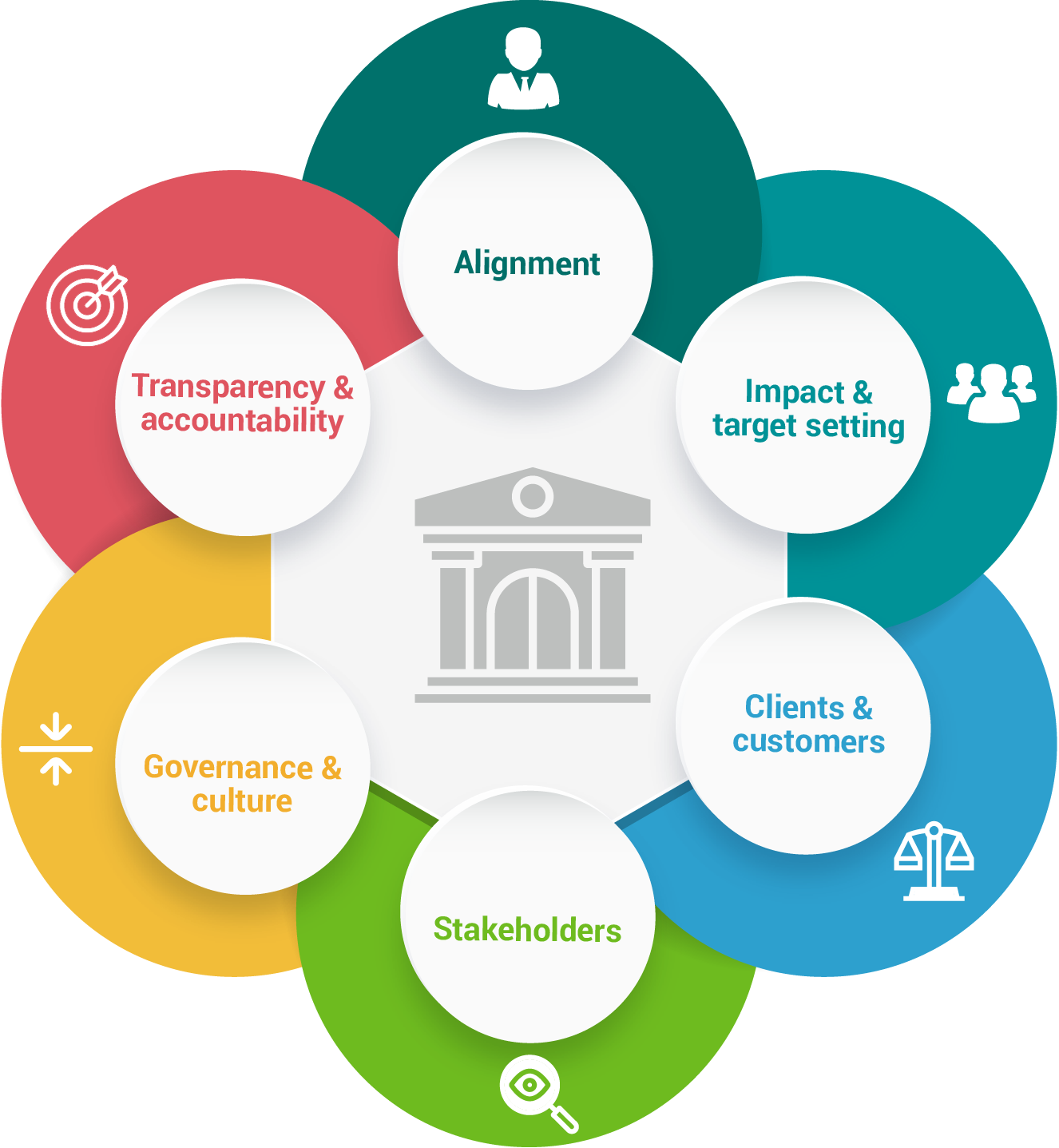

The PRB comprise six principles, namely Alignment, Impact and Target Setting, Clients and Customers, Stakeholders, Governance and Culture, and Transparency and Accountability. Conforming to the PRB, CTBC Bank incorporates sustainable goals into its businesses and focuses on various aspects of ESG development. By developing more socially responsible financial products and operational processes, CTBC Bank is ensuring the positive influence of its financing activities and investment portfolios while shouldering the responsibility of environmental protection.

CTBC Bank’s implementation outcomes of PRB, please refer to the 2022 PRB Reporting and Self-Assessment with the analysis of impacts and target setting. CTBC Bank will develop specific action items so as to further implement the PRB and fulfill its corporate social responsibility.