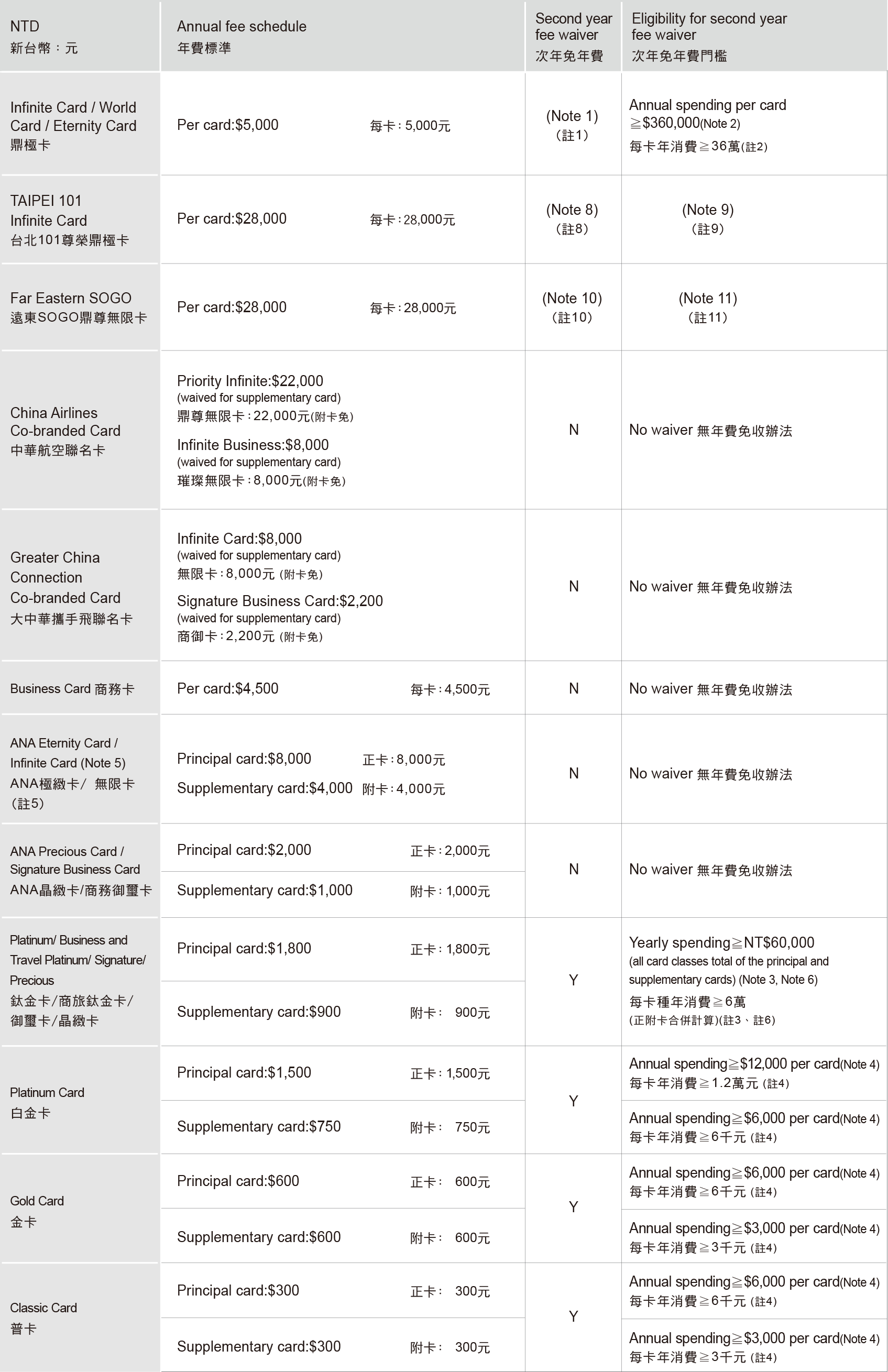

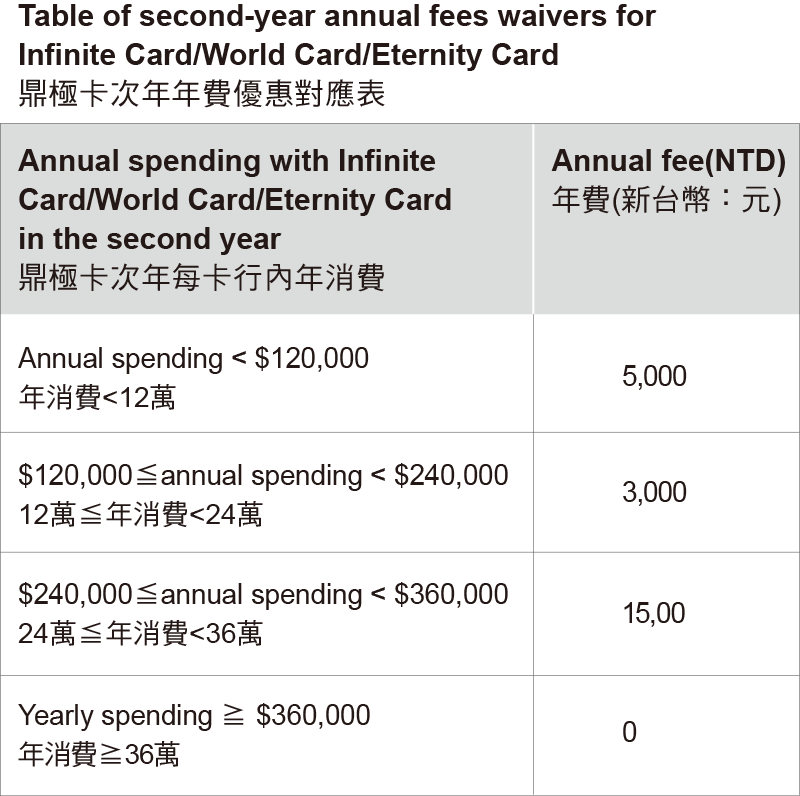

| Note1: |

Registered CTBC cardholders with annual spending≧$360,000 can enjoy first-year annual fee waiver for Infinite Card/World Card/Eternity Card (valid for up to 2 cards; charges will assessed as per set annual fee starting with third Infinite Card/World Card/Eternity Card card).

註1:中信卡歸戶年消費≧36萬元得享鼎極卡首年免年費優惠(歸戶以2卡為限,第3張(含)以上之鼎極卡依年費定價收取)。 |

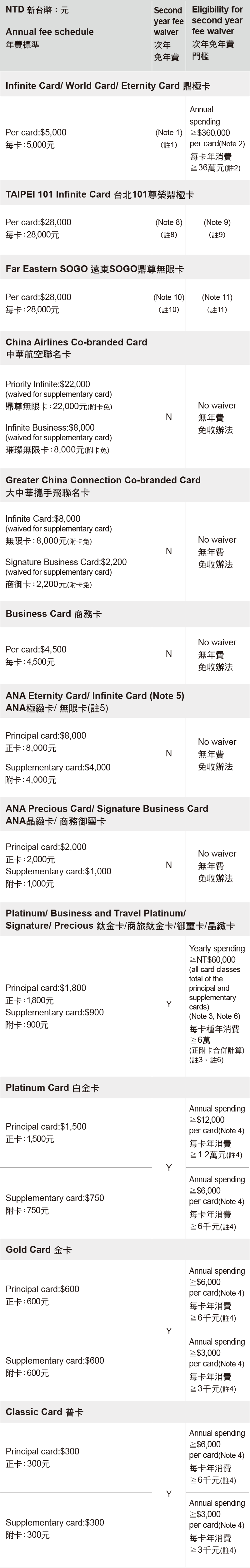

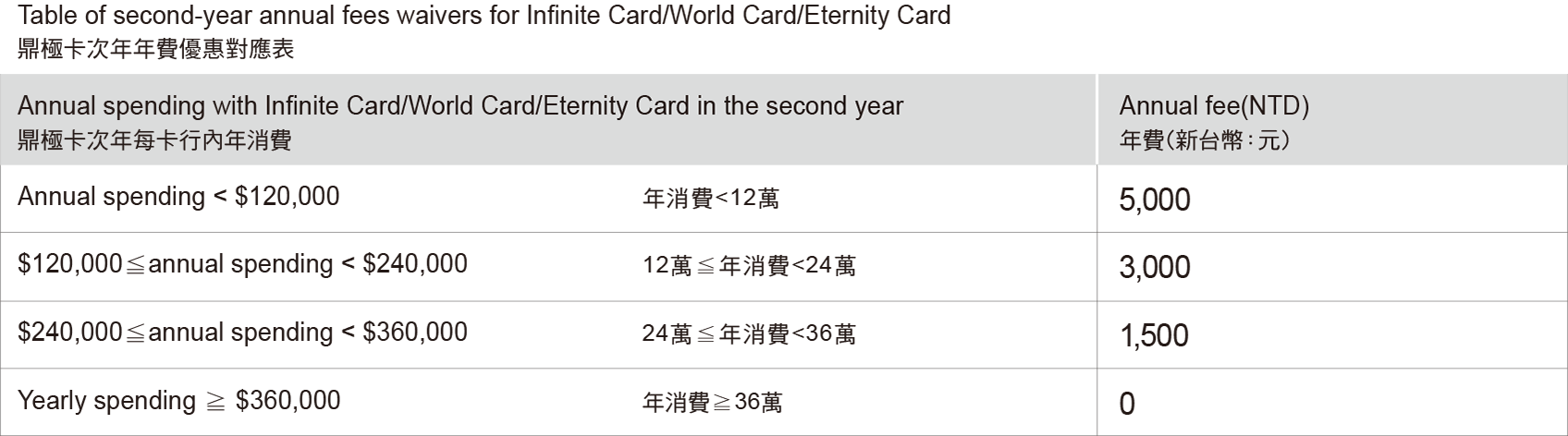

| Note2: |

First Year or Second Year Annual Fee Discount for Infinite Card/ World Card /Eternity Card Holders of Infinite Card/ World Card /Eternity Card are eligible for annual fee discount or waiver as illustrated in the table above; CTBC wealth management customers enjoy additional annual fee discount or waiver for Infinite Card/ World Card /Eternity Card; for eligibility, please refer to relevant rules in CTBC Wealth Management Consumer Rights Guide, or go to CTBC website for detailed information.

註2:鼎極卡次年年費優惠對應表:一般客戶鼎極卡按上表享年費優惠;本行財富管理貴賓另享鼎極卡年費減免優惠,適用資格依本行財富管理權益手冊相關規定,詳情請上網查詢。 |

| Note3: |

(1)Reapplication for Titanium/ Business Travel Titanium/ Signature/ Precious Card within one year after cancellation or termination of the same product will require annual fee.

(2) Annual spending on Titanium/ Business Travel Titanium/ Signature/ Precious Card will be calculated separately; second-year annual fee is waived if the new annual spending on principal and supplementary cards combined during the annual fee period reaches $60,000 or more, or the status of Chuan, Ding, Shou or Chuang Wealth is maintained in the month second-year annual fee is charged.(Not applicable to Greater China Connection Co-branded Card Signature Business Card, Corporate Card, Business Card, ANA Precious Card/Signature Business Card) 註3:(1)鈦金卡/商旅鈦金卡/御璽卡/晶緻卡同產品註銷或停用未滿一年再申辦者,皆需繳交年費。(2)鈦金卡/商旅鈦金卡/御璽卡/晶緻卡種之年新增消費金額分開計算,正、附卡於年費計算期間累計年新增消費金額合併計算達6萬元(含)以上或計收年費當月維持傳富家、鼎富家、首富家、創富家資格即免次年年費。(但大中華攜手飛聯名卡商務御璽卡、公司卡、商務卡、ANA晶緻卡/商務御璽卡不適用) |

| Note4: |

For types of credit card below Platinum, new annual spending on principal and supplementary cards will be calculated separately. Second year annual fee will be waived if cumulative new annual spending on separate cards during the annual fee period reaches the designated amount.

註4:白金卡以下各卡種之年新增消費金額正、附卡分開計算,於年費計算期間累計年新增消費金額達指定金額含以上即免次年年費。 |

| Note5: |

The annual fee application period for China Airlines Co-branded Card Priority Infinite/Infinite Business is 2025/7/1–2025/12/31;The annual fee application period for ANA Eternity/ANA Infinite/ANA Precious/Business Signature is 2025/7/1–2025/12/31.

註5:中華航空聯名卡鼎尊無限卡/璀璨無限卡年費收費標準適用期間為114/7/1~114/12/31; ANA極緻卡/無限卡/晶緻卡/商務御璽卡年費收費標準適用期間為114/7/1~114/12/31。 |

| Note6: |

An annual fee will be required for reapplication for the same product within one year after cancellation or termination of a China Airlines Co-branded Card or Signature Business Card. Annual increases in spending on the same card class from this bank (Signature Card/Titanium Card/Precious Card) will be calculated separately; the second-year annual fee is waived if the new annual spending on principal and supplementary cards combined during the annual fee period reaches $60,000 or more, or the status of Private Plus Family Banking, Private Family Banking, Wealth Plus Family Banking, and Wealth Family Banking is maintained.

註6:中華航空聯名卡商務御璽卡同卡種註銷或停用未滿一年再申辦者,皆需繳交年費。持有本行相同卡種(御璽卡/鈦金卡/晶緻卡)之年增消費金額分開計算,正、附卡於年費計算期間累計年新增消費金額合併計算達6萬元(含)以上或計收年費當月維持傳富家、鼎富家、首富家、創富家資格即免次年年費。 |

| Note7: |

If the principal and supplementary cards for the LINE Pay Card, League of Legends Card, Yahoo Card, or Cool One Card have the same design on the face, then they can be combined when calculating the amount spent. If the design on the face of the card is different, then they shall be calculated separately.

註7:LINE Pay卡、英雄聯盟卡、Yahoo卡正附卡如為相同卡面圖樣者可合併計算其消費金額,如為不同卡面圖樣則應分別計算之。 |

| Note8: |

When members of the Private Privilege/Private Plus and Taipei 101 Prestige Club are invited to apply for a credit card,they will enjoy a first-year annual fee waiver.

註8:本行財富管理臻富家/傳富家及台北101尊榮俱樂部會員邀請核發信用卡時,享首年免年費。 |

| Note9: |

Private Privilege/Private Plus,and Taipei 101 Prestige Club whose membership is still valid when the credit card annual fee is charged will enjoy a second-year fee waiver.

註9:本行財富管理臻富家/傳富家及台北101尊榮俱樂部會員於收取信用卡年費時仍維持其資格者,及享次年免年費。 |

| Note10: |

When members of the Private Privilege/Private Plus and Far Eastern SOGO are invited to apply for a credit card,they will enjoy a first-year annual fee waiver.

註10:本行財富管理臻富家/傳富家及遠東SOGO會員邀請核發信用卡時,享首年免年費。 |

| Note11: |

Members of the Private Privilege/Private Plus and Far Eastern SOGO whose membership is still valid when the credit card annual fee is charged will enjoy a second-year fee waiver.

註11:本行財富管理臻富家/傳富家及遠東SOGO會員於收取信用卡年費時仍維持其資格者,及享次年免年費。 |

*Please refer to annual fee schedule posted on CTBC website for the method of calculating new annual spending.

※年新增消費金額計算方式,請參考本行網站年費公告說明。

*The annual fee schedule and waiver rules shall be dictated by those published by CTBC at the time the annual fee is due.

※年費收費標準及免收辦法以產生年費時本行最新公告為準。