CTBC Bank has a genuine commitment to sustainable finance. We are constantly taking on greater corporate social responsibility and putting sustainable development at the core of our business. As part of these efforts, we proudly became a signatory to the Equator Principles on January 23, 2019.

We use these principles—which are widely regarded as constituting best practice in sustainable finance—to actively manage the potential environmental and social risks of our corporate loans. This not only helps prevent negative repercussions for the Bank, both financial and non-financial, but delivers tangible protection to the community. Adopting the Principles is a key step for us in working more closely with clients to realize our vision of corporate citizenship and emphasize that “We are family” is much more than a slogan.

- The Equator Principles

- The Equator Principles (EPs) are a voluntary standard based on the sustainable development policies and guidelines of the International Finance Corporation and the World Bank. The Principles together form a risk management framework that financial institutions can use to assess and manage the environmental and social risks of potential corporate projects.

- As a signatory, we apply the Principles by weighing the risks of five financial products: project finance advisory services, project finance, project-related corporate loans, bridge loans, and project-related refinance and project-related acquisition finance. Each of these is classified into one of three categories, A, B, or C, based on the seriousness of its potential environmental and social risks. For projects that pass the process, we utilize covenants and post-loan monitoring to ensure compliance with the Principles even after financial close.

- More details are available at the Equator Principles and International Finance Corporation websites.

How we adopted the EPs

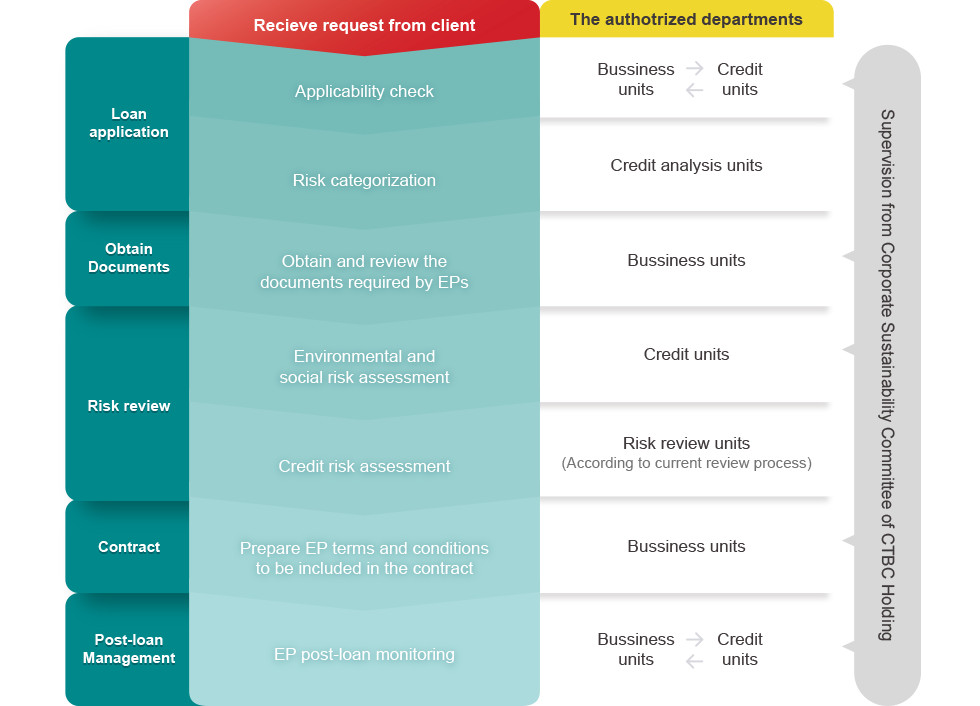

The Bank established Guideline for Corporate Loan Applicable to the Equator Principles. It authorizes CTBC Holding's Sustainability Committee to supervise all relevant business, risk management, and administrative units to ensure they fulfill their respective roles and responsibilities in ensuring Equator Principles-compliant environmental and social risk management when assessing corporate loans.

The guideline clearly lays out the roles and responsibilities of all relevant units, the credit process for Equator Principles-applicable projects, the terms and conditions for such projects, and information disclosure management. For our subsidiaries in Japan, Indonesia, the Philippines, the United States, and Canada, localized policies have been established to ensure their implementation of the Principles is consistent with that of the parent company.

The Bank assigns tasks in accordance with the existing roles and responsibilities of its units, the key duties of which are as follows:

-

Business unitsidentify projects for which the Principles are applicable and communicate with clients regarding the relevant requirements and documents.

Business unitsidentify projects for which the Principles are applicable and communicate with clients regarding the relevant requirements and documents. -

Credit analysis unitsconfirm that the Principles are applicable, determine projects' risk categories, conduct environmental and social risk assessments, and perform post-loan reviews.

Credit analysis unitsconfirm that the Principles are applicable, determine projects' risk categories, conduct environmental and social risk assessments, and perform post-loan reviews. -

Risk management unitsformulate and amend the Bank's Equator Principles management policies and procedures and conduct credit reviews that take into consideration the environmental and social risk assessment results.

Risk management unitsformulate and amend the Bank's Equator Principles management policies and procedures and conduct credit reviews that take into consideration the environmental and social risk assessment results.

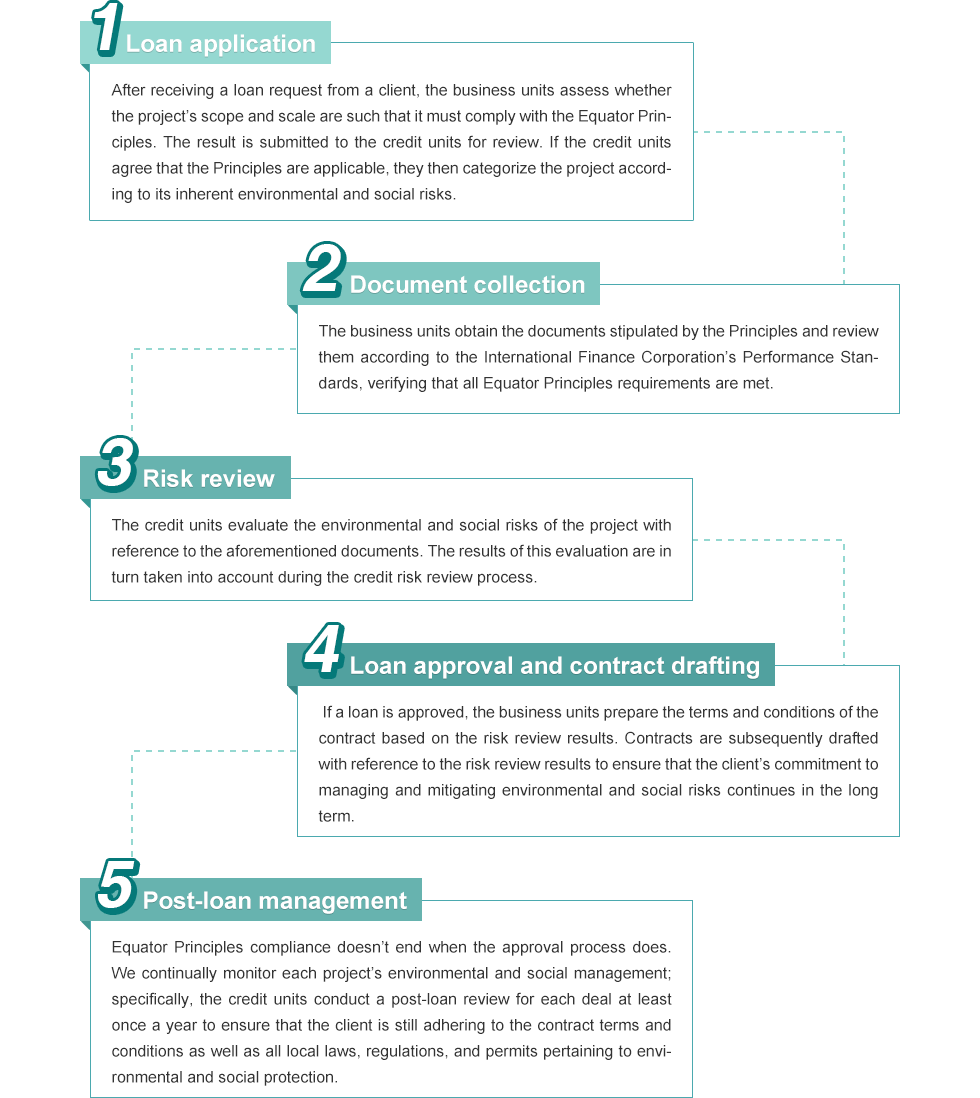

Our credit process for EP projects

Real sustainability requires the comprehensive management of environmental and social risks; that's why we’ve integrated the Equator Principles into each step of the CTBC Bank credit process. Here's a broad breakdown of it: